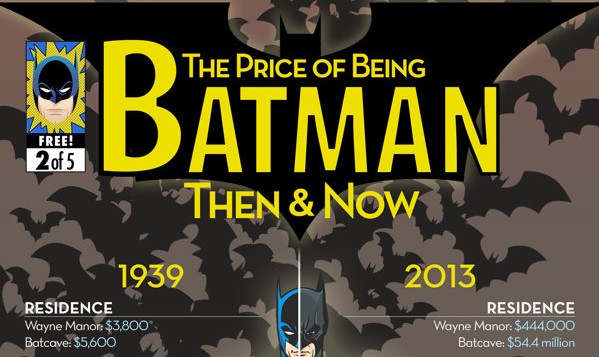

Business is pretty easy. I wish we taught accounting and finance basics in sixth grade. Alas, I didn’t even learn how to balance a checkbook during my high priced stint at a private college for a Business Administration degree. However, once I learned business basics – stumbling through our family business and with the help of great mentors, including Warren Buffet, Frank Blau – I was gob smacked by how easy it is. When you charge more than it costs for something you create a profit. You manufacture your own money. When you take that profit in cash (as opposed to letting it decompose in Accounts Receivable) you can use that cash to grow your business. You can use that cash to turn around a bad financial situation. Money buys options. Money can fix things. Not everything. But just about everything is easier with some cash on hand.

Business is pretty easy. I wish we taught accounting and finance basics in sixth grade. Alas, I didn’t even learn how to balance a checkbook during my high priced stint at a private college for a Business Administration degree. However, once I learned business basics – stumbling through our family business and with the help of great mentors, including Warren Buffet, Frank Blau – I was gob smacked by how easy it is. When you charge more than it costs for something you create a profit. You manufacture your own money. When you take that profit in cash (as opposed to letting it decompose in Accounts Receivable) you can use that cash to grow your business. You can use that cash to turn around a bad financial situation. Money buys options. Money can fix things. Not everything. But just about everything is easier with some cash on hand.

My great mentors taught me business basics. Warren Buffet taught me how to read a Balance Sheet. Note that I have never met Mr. Buffet in person. However, smart people write books. This is what I learned from his…

In business, there is ultimately one financial Scorecard: The Balance Sheet. Every other financial report is a subset of the Balance Sheet. This is the Balance Sheet equation…

Assets = Liabilities + Equity

Assets = Claims on the Assets. This equation is in line with the universal law…what goes around comes around. Or, for every action there is a reaction. It’s how we keep financial score in the game of business.

What Warren Buffet taught me about business…

Warren Buffet makes money the bare bones basic way. He buys and builds companies that make profits. Here are his rules for business…

- Protect the Assets. The assets are your ‘stuff.’ What you have. The first financial objective is to protect the wealth you have.

- Grow the Assets. The second financial objective is to expand the ‘stuff.’ Grow Cash and other Assets.

That’s the game! Let’s look at the three ways that you can grow Assets.

- Through Liabilities. You can borrow money. When you buy a new truck, and get a loan for that truck…Assets go up and the Liability (a loan) goes up. (Maybe you have already overdone this? It’s easy to get in too deep in debt, as individuals and as a nation.)

- Through Owner Investment. You can put your own money into the company. Perhaps when you got started you wrote a check from your personal checking account and opened up your business checking account. Assets go up and Owner’s Investment (an Equity account) goes up. Are you looking for Venture Capital? If an investor cuts a check and puts it in your checking account, then his Owner’s Equity goes up. At that point, he may own more of your company than you do. Just be aware.

- Through Profits. Sell stuff for more than it costs and create profits. Assets go up and Net Income goes up. This year’s profits show up in the Equity section of your Balance Sheet. When you lose money – sell stuff for less than it costs you – Equity goes down and Assets go down. That’s the elegant, beautiful, sometimes horrible truth of the Balance Sheet.

BONUS! Another benefit of profit…you can use it to pay down your debt! Instead of always trying to get by on less, consider how you can make more profits. Consider what it will do to collect in cash now…and stop financing your customers.

Are you winning or losing the game?

First off, make sure the Balance Sheet is right. Don’t make decisions on messy or erroneous information. Clean up the accounts and get them current. Then, take a look at the numbers. If you have more Liabilities than Assets, you are going backwards. You’ll have a negative Equity balance. You may be able to fix it. The long term fix is to address the reason you got in trouble in the first place. You have got to charge more than it costs. And you have to have enough Sales at the right price to cover all expenses and make a profit. You might be able to borrow more money and you may be tempted to put more of your own money into the company. You might even entice an investor to infuse some cash. However, the only way to create wealth is to generate profits.

What Frank Blau taught me about business…

Frank is the one who helped me put my first Budget together. He suggests that you start a Budget by listing all your Expenses. Jot down – in a spreadsheet or on a columnar pad – what you want to spend on you and your team. Put in proper salaries and wages for the wonderful, skilled, valuable work that you do. Then, address every Expense account and be generous. Provide nice trucks, uniforms, benefits, marketing dollars. Hold your chin up as you create a Budget based on reasonable Expenses to do what you do really well.

Then, put in the Sales amount. Make the Sales total bigger than the Expenses to your desired amount of Profit. Then, take that Sales amount and divide it up by the number of “Widgets” you could sell. If you sell Labor, your Widget is an hour, or a day. It’s a unit of time. If you sell T-shirts, divide the Sales up by the number of T-shirts you could sell. Play out a few scenarios.

Frank taught me that a Budget helps you set Goals and come up with a Selling price that will help you reach those Goals. Nice! When you do this, as I did, you will discover that your Selling Price is higher than a lot of your competitors. Gulp.

Here’s another thing Frank taught me…

Be better. Be faster, stronger, nicer, more current, better equipped….or all of those things. Be a better marketer and salesperson so you can communicate why and how your are better. Then, you will get sales at your price and your will make more money.

Business is easy. And, profits solve lots of problems.